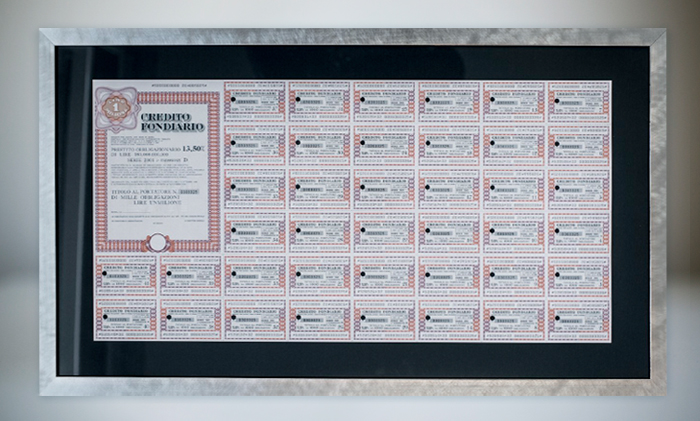

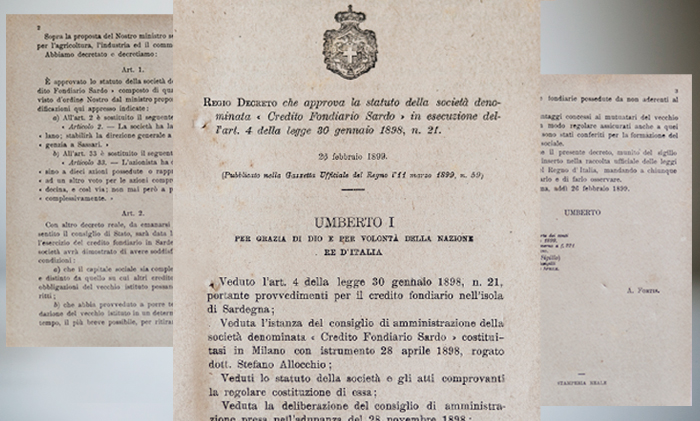

Gardant Group was born in 2021 from the reorganisation of the Credito Fondiario Banking Group as specialised hub in the activities of managing and investing in non-performing loans.

Today, Gardant is a leading operator in Italy with over EUR 40 billion in managed loans, approximately EUR 20 billion in special servicing loans, and EUR 1.2 billion in investments made in non-performing loans (purchase price).