Sustainability

ESG: Commitment to sustainability

The Gardant Group operates with the conviction that the integration of sustainability is first and foremost a moral and institutional duty, as well as a useful tool to strengthen its business model, improve its competitive position in the market and obtain a growing influence at a national and international level recognised by all key stakeholders.

Since its establishment, the Gardant Group has been committed to recognising the impact of its operations on the environment and on its stakeholders:

The Board of Directors of Gardant S.p.A. approved the ESG Master Plan, which represents a true strategic plan on ESG matters (hereinafter referred to as the “Plan”).

The Plan outlines the path towards the objective of integrating sustainability into business and operations and sets the relative actions to be implemented over a three-year period, with the involvement of the entire structure.

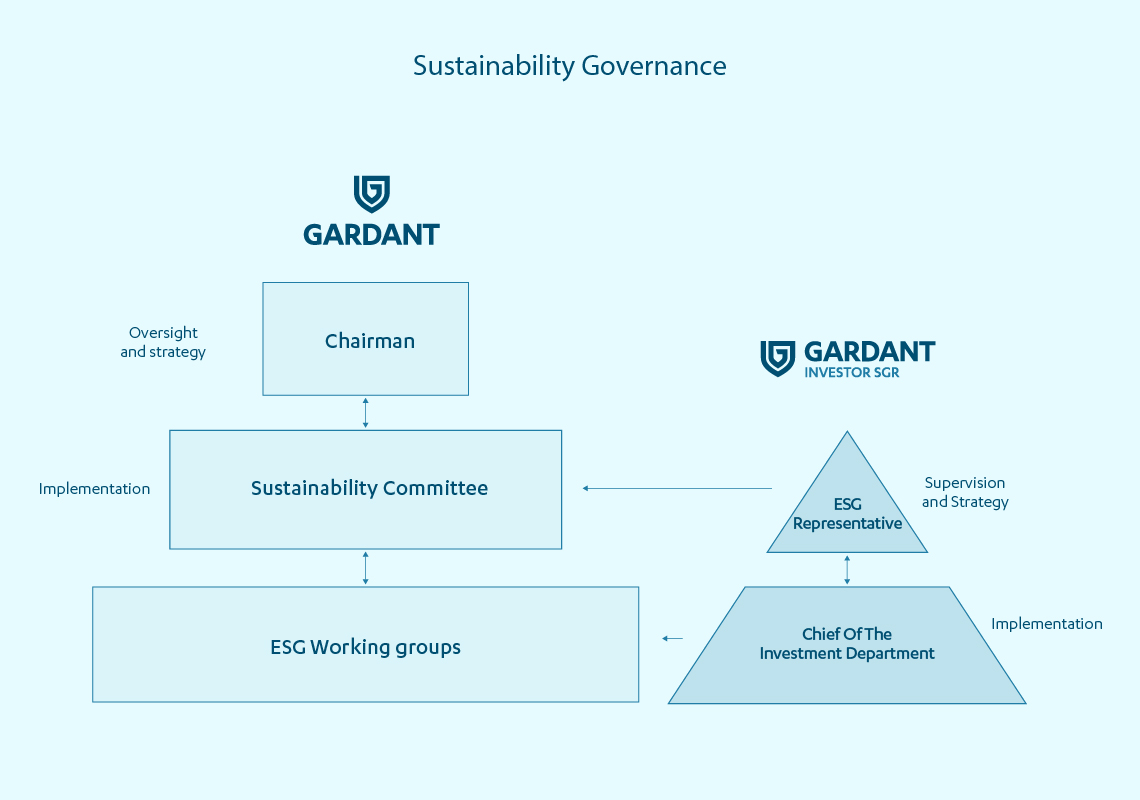

One of the actions set forth in the Plan, which was achieved in conjunction with the establishment of the Gardant Group and the approval of the Plan itself, is the infrastructure for sustainability governance, i.e. the organisational structure and body of regulations.

The organisational structure is made up of the Sustainability Committee and the ESG, Communication and External Relations Office – which expresses the ESG Manager – and the ESG Working Groups, the latter being in charge of defining the operational methods for implementing actions.

The body of regulations drawn up at inception consists of the Sustainability Policy and the Responsible Investment Policy (hereinafter referred to as the “SRI”). It is supplemented by other internal regulations, structured and updated according to the evolution of the external context and that of the Group, its vision and business model, consistent with the defined sustainability priorities and taking into account the expectations of its stakeholders.

The Sustainability Committee and ESG Working Groups meet quarterly and monthly, respectively.